The Fatal Flaw of Predicting College Prices

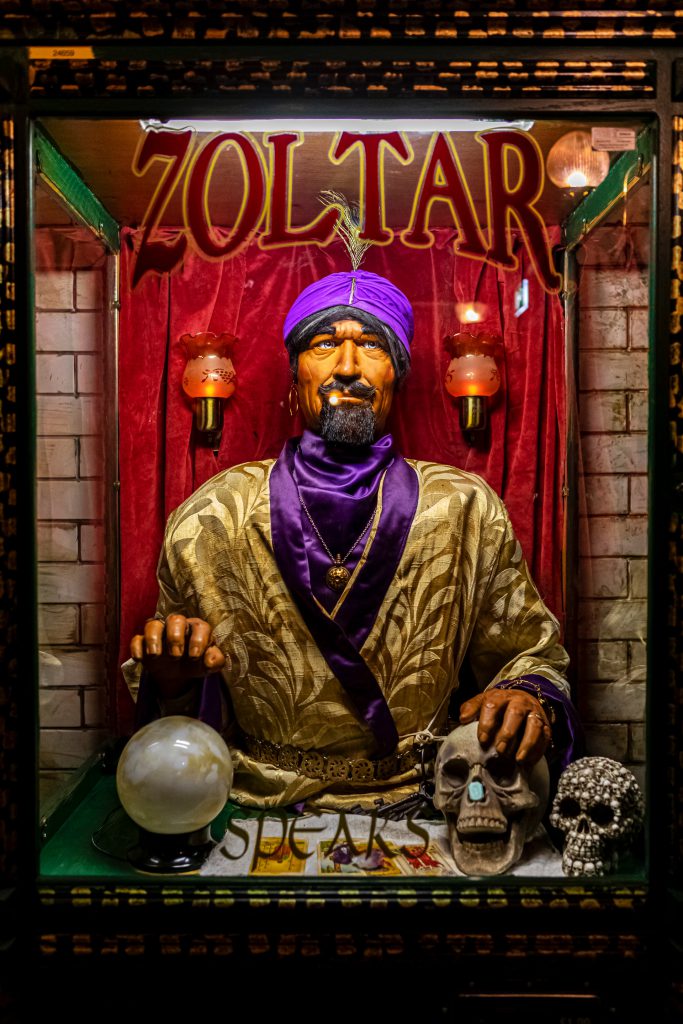

Can you name a movie where some sort of spirit world wizardry correctly predicts a fantastic future? (Big? Field of Dreams? Every animated Disney movie?). Unfortunately, for every one of those fantasies, there’s a million fortune cookie predictions that turn out to be way off. At least it’s just harmless fun if you don’t have any skin in the game, right?

Sadly, paying for college is the polar opposite of harmless fun. In recent decades, a whole generation of students and parents have been blindsided by an avalanche of college debt. Why? Because they relied on a price predictor to narrow their list, only to find out months later that those predictions were about as reliable as a magic 8-ball.

No matter the source, the problem remains the same. In the absence of clear pricing info, consumers can fall for even the vaguest promise of certainty. Especially if that promise lets them believe what they wish to be true. In a multistage process like college admissions, choices made early on dictate the quality of options at the final stage. And relying too heavily on the results of a college price predictor too often come back to bite students and families. Hard.

Colleges and online companies work pretty hard to make their price predictor (or estimator or calculator) look like the essence of precision. (Throw in a couple of references to artificial intelligence and machine learning, and most folks swoon in an instant). But no matter how reliable they might seem, college price predictors play on two illusions that seduce even the smartest consumer.

- First, they create an illusion of accuracy that is, at best, relative.

- Second, they create an illusion of power that evaporates in the real world.

Accuracy is relative, and the consumer ain’t family

It turns out that “accuracy” doesn’t mean the same thing to individual shoppers and higher ed institutions. Remember the phrase “good enough for government work”? This gem captures the problem perfectly.

For a college that brings in roughly $10 million from tuition every year, a price projection within $10,000 of the actual price is wonderfully precise.

But for a typical American family walking a financial tightrope to pay for college, that kind of precision is pretty useless. Forty thousand dollars in unanticipated costs over four years would put many American families on the street. Multiply this dilemma by thousands of colleges and universities across the country, and the enormity of the problem comes into view pretty quickly.

If that weren’t enough, the dependability of any estimating equation depend on the quality of the available data. Garbage in, garbage out. Unfortunately, the primary source of data used to predict college prices is 2-3 year-old. Can you think of events since 2019 that might wreck the predictive quality of that data? Exactly.

The bottom line is not that all price predictor tools are never accurate. The bottom line is that there’s no way to know what predictor can predict which college price accurately enough for you.

The predictor giveth, and the fine print taketh away

The fine print, something you’ll usually have to find in the depths of the legalese at the bottom of each college price predictor, undermines the whole point of the tool. Here are two examples, but every price predictor, estimator, or calculator has a similar disclaimer.

“The estimate provided using this net price calculator does not represent a final determination or actual offer of financial assistance. The cost of attendance and financial aid availability may change. This estimate shall not be binding … ”

“All information provided on this website or through the Service is for informational purposes only. You agree that any reliance on the information on this website or through the Service is at your own risk and that we do not represent that the Service is reliable, accurate, complete, or otherwise valid.”

Again, this doesn’t mean that none of the college price prediction tools will ever give you an accurate result. But we now know from a validation study of actual price predictor tools that these tools vary in accuracy and are often misleading. In the case of the net price calculator, when the federal government mandated that every college and university add one to their website, they never required them to be accurate. Sigh.

Unfortunately, if you relied on a particular price predictor to narrow your college list only to find out later that your actual price didn’t match your predicted price, you are stuck. That power that you thought you had based on the information you received? Gone. Try bringing your predicted price to the financial aid office as a negotiating ploy. They’ll refer you to the fine print. (Ignore the snicker. It’s a rough time to be in financial aid).

Both/And is always better than Either/Or

No one wants to get blindsided by a higher price than they expected to pay. That’s especially true if you’ve narrowed your college list based on a predicted price you thought you could depend on. If you are going to use a net price calculator or an online college price prediction service, recognize that those tools have limitations that won’t reveal themselves until months later.

To prevent ending up in a fine print fiasco, consumers need to know the actual prices that colleges are charging in real-time. That includes both at the colleges they are considering AND what similar students are receiving from other colleges. This is why combining TuitionFit data with any estimated prices you’ve found online is amazingly helpful. Combining data sources gives you the best information and leverage to ensure that you pay a fair price.